About Us

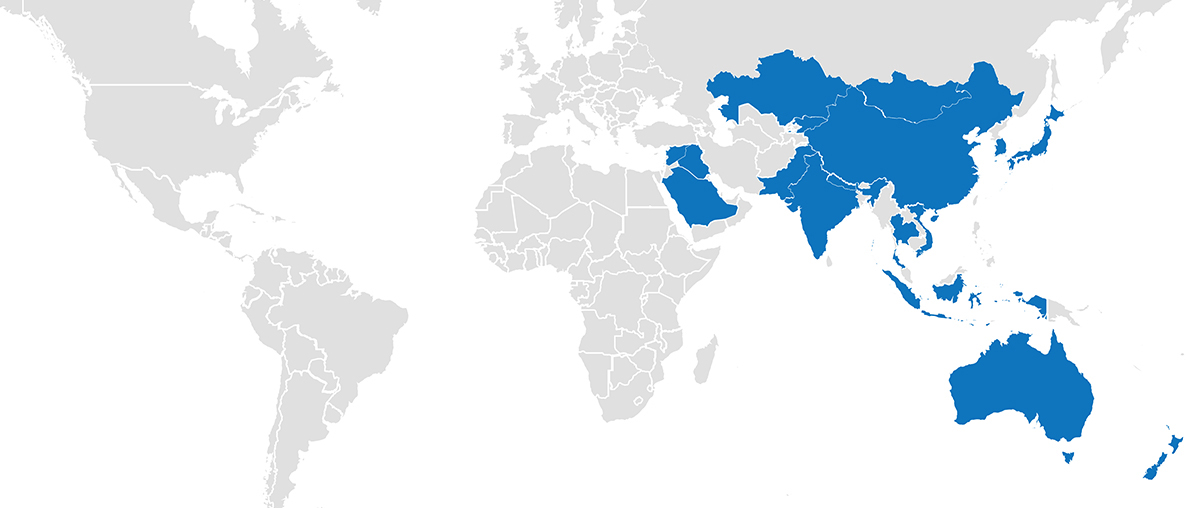

The Asian-Oceanian Standard-Setters Group (AOSSG) is a group of the accounting standard-setters in the Asian-Oceanian region. The group has been formed to discuss issues and share experiences on the adoption of International Financial Reporting Standards (IFRS) and to contribute to the development of a high-quality set of global accounting standards. The AOSSG plans to play an important role in encouraging the adoption/convergence of IFRSs in the region. Read More

Member Organisations of AOSSG

- 1. Australia - Australian Accounting Standards Board

- 2. Bangladesh - Financial Reporting Council

- 3. Brunei - Brunei Darussalam Accounting Standards Council

- 4. Cambodia - Ministry of Economy and Finance of Cambodia

- 5. China - China Accounting Standards Committee

- 6. Dubai - Dubai Financial Services Authority

- 7. Hong Kong - Hong Kong Institute of Certified Public Accountants

- 8. India - The Institute of Chartered Accountants of India

- 9. Indonesia - The Indonesian Institute of Accountants

- 10. Iraq - Iraqi Union of Accountants and Auditors

- 11. Japan - Accounting Standards Board of Japan

- 12. Kazakhstan - Chamber of Auditors of the Republic of Kazakhstan

- 13. Korea - Korea Accounting Standards Board

- 14. Macao SAR - Professional Committee of Accountants

- 15. Malaysia - Malaysian Accounting Standards Board

- 16. Mongolia - Mongolian Institute of Certified Public Accountants

- 17. Nepal - Accounting Standards Board

- 18. New Zealand - External Reporting Board

- 19. Pakistan - Institute of Chartered Accountants of Pakistan

- 20. Philippines - Financial Reporting Standards Council

- 21. Saudi Arabia - Saudi Organization for Certified Public Accountants

- 22. Singapore - Singapore Accounting Standards Council

- 23. Sri Lanka - The Institute of Chartered Accountants of Sri Lanka

- 24. Syria - Association of Syrian Certified Accountants

- 25. Thailand - Federation Of Accounting Professions

- 26. Uzbekistan - National Association of Accountants and Auditors of Uzbekistan

- 27. Vietnam - Ministry of Finance

Chair’s Advisory Committee

MR. NISHAN FERNANDOCURRENT CHAIR, AOSSG

MR. RANA MUHAMMAD USMAN KHANCURRENT VICE-CHAIR, AOSSG